arizona charitable tax credits 2020

The maximum contribution allowed is 800 for married filing joint filers and 400 for single heads of household. There are four major tax credits that you can use to offset certain charitable donations in Arizona.

Qualified Charitable Organizations Az Tax Credit Funds

The lists of the certified charities on azdorgov displays the certified charities for that year.

. Tax Credits Forms. A taxpayer can only claim a tax credit for donations made to certified charities. Application for Certification for Qualifying Charitable Organization.

You can provide the in-home safety education module to a family for just 400. And many online services allow you to complete this form digitally while doing your taxes To give. Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

As most of us prepare to say goodbye to 2020 its also time to send in your Arizona Charitable Tax Credit gift. Your investment of 800 supports community families growth in communication child development discipline and. For voluntary contributions made to a qualifying foster care charitable organization QFCO see credit.

Schwab Charitable makes charitable giving simple efficient. Learn More At AARP. A charitable organization must complete the application.

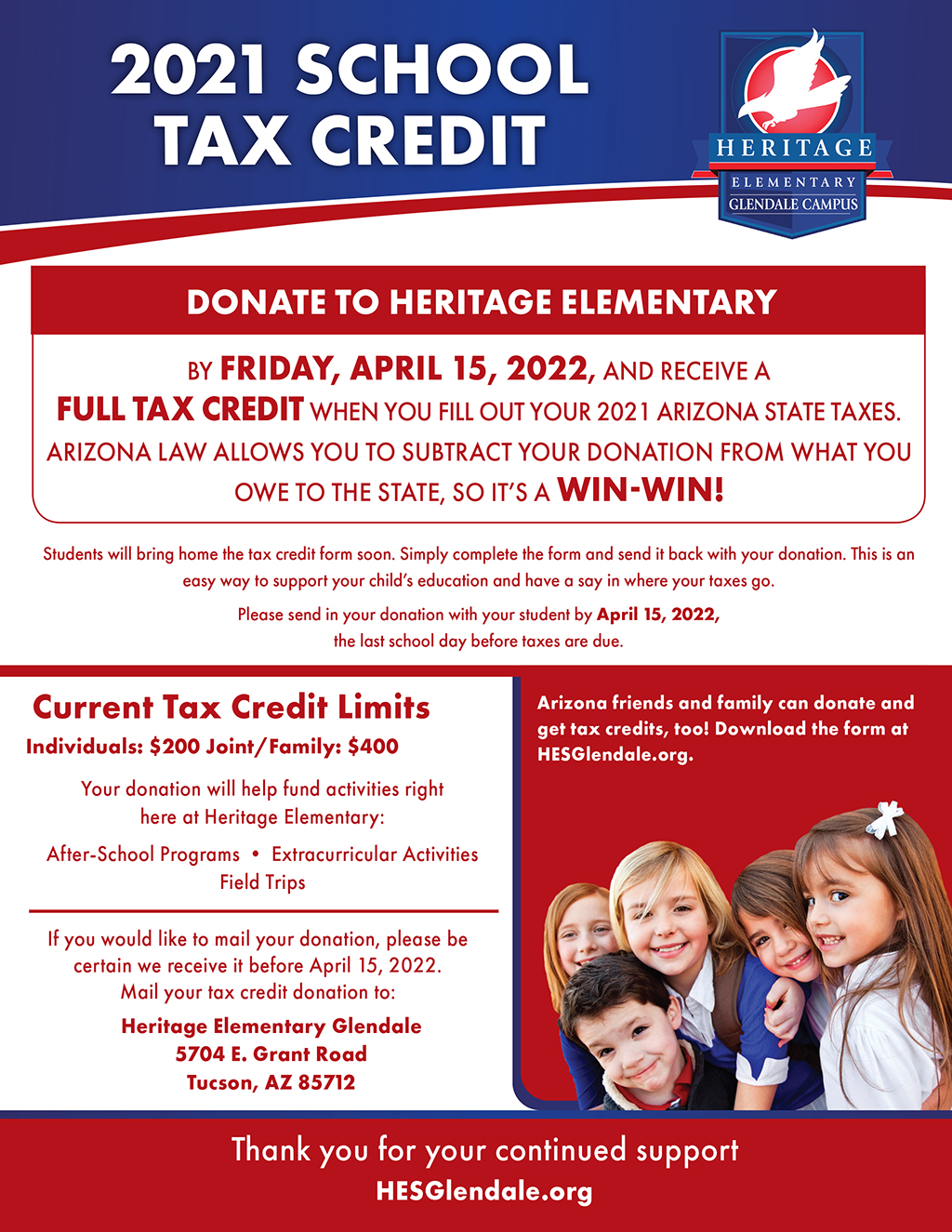

Name of Organization Address Phone QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20841 Arizona Assistance in. The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing. Rules for Claiming Arizona Tax Credits for Donations.

1 Best answer. Phoenix Rescue Mission will provide you with a year-end giving summary by April 15 2022. You may receive a dollar-for-dollar tax credit for contributions to the following types of charitable organizations.

Consider the example of a single taxpayer who makes a 400 donation to an eligible. Make your tax credit donations from one easy-to-use site. Find Fresh Content Updated Daily For Az tax credit donations.

10 rows Arizona Small Business Income Tax Highlights. Effective in 2018 the Arizona Department of Revenue has assigned a five 5 digit code number to identify each Qualifying Charitable Organization and Qualifying Foster Care Charitable. Taxpayers will find everything they need to know in order to take.

Just make sure to your contribution to RMHCCNAZ up until. February 5 2020 311 PM. This change is in effect until June 30 2022.

The Arizona Charitable Tax Credit gives taxpayers more choice in how their tax dollars are allocated. For all of them you. The Arizona Charitable Tax Credit is an individual income tax credit for charitable contributions to Qualifying Charitable Organizations.

Ad 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash. Many Arizonans prefer to make their tax liability gift before.

This credit is limited to the amount of tax calculated on your Arizona return. Ad Learn how to give to your favorite charities and maximize tax benefits. Fortunately this is the ultimate guide to the Arizona Charitable Tax Credit in 2020 a true deep dive into the details.

What You Need To Know About Arizona 2021 Tax Credits

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How Federal And Arizona Tax Incentives Can Help You Donate To Charity

Pin On Association For Vascular Access

Az Charitable Tax Credits Explained Gompers

With 35 0 Continuing Education Credits Set To Be Available Avaatyourfingertips Is Continuing Education Credits Continuing Education Md Anderson Cancer Center

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Mesa United Way Have You Ever Thought About Giving To Mesa United Way Through Tax Credits Well The Arizona Charitable Tax Credit And Foster Care Tax Credits Help Us Do Important

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

Tax Credit Heritage Elementary Schools Glendale Glendale Charter School

Will You Partner With Us To Help Those In Need

Arizona Tax Credits Mesa United Way

Charity Tax Concessions And Endorsements Acnc

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Score A 2020 Arizona Tax Credit Henry Horne

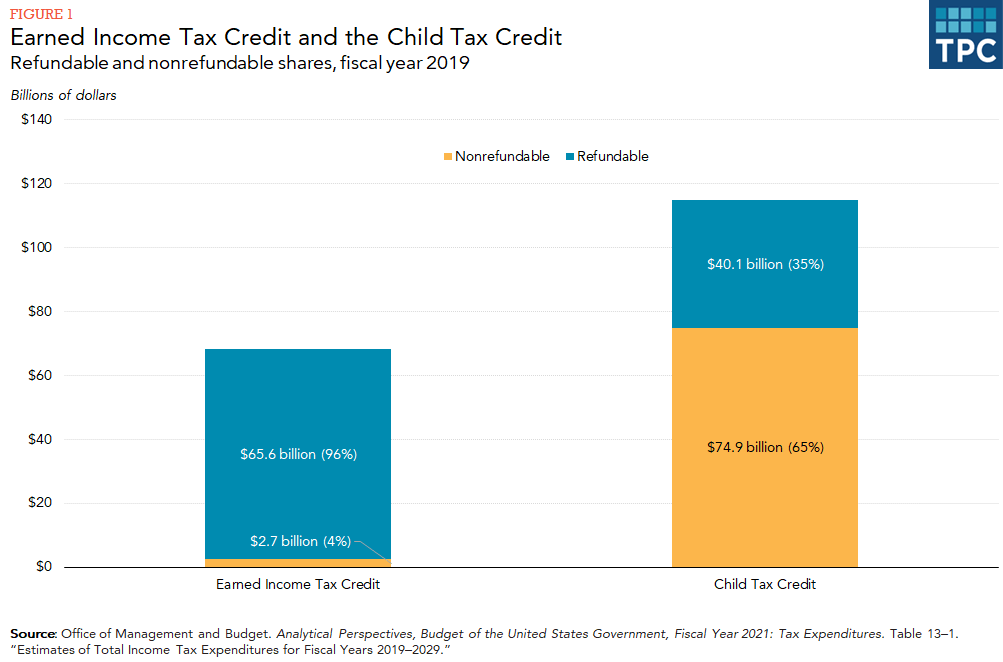

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S